Empowering

Your Business

Connecting the dots

What we do ...

At SCG we focus on connecting businesses with specialists in comprehensive tax consulting, business funding, employee benefits & perks, legal advisory and insurances, thereby providing introduction services that are tailored for the SME market.

Our proactive referral network ensures that both parties have the right resources at their fingertips.

In essence, we connect the dots.

Why we do it

Businesses often need specialist advice or services and don’t have any existing contacts to provide the services, or don’t know they need advice, or are unaware of available relevant services ... or they get referrals from their mates (usually in the pub) that are often unreliable, not expert, not vetted, not capable of providing services.

We act as a reliable resource for specialist services by ensuring that the providers of services are:

- Real experts in their field

- Competent providers

- Due diligence / Vetted (company background, financials, FCA regulated / Accounting body etc.)

Saving the client time, money and hassle of finding the correct provider.

We ensure that the relevant expertise is directly introduced to the company requiring services and that it does not add to the cost of the service.

Why Choose SCG?

We facilitate the introduction of expert guidance in tax, tax relief, employee benefits and perks, general insurance and various other relevant matters with proactive solutions designed for the SME market.

We're here to support your business growth and protection, providing comprehensive services that save you time, effort and resources.

We focus on connecting businesses with a robust network of vetted specialists, providing introduction services that are tailored for the SME market. Our proactive referral network ensures that both parties have the right resources at their fingertips.

In essence, we connect the dots.

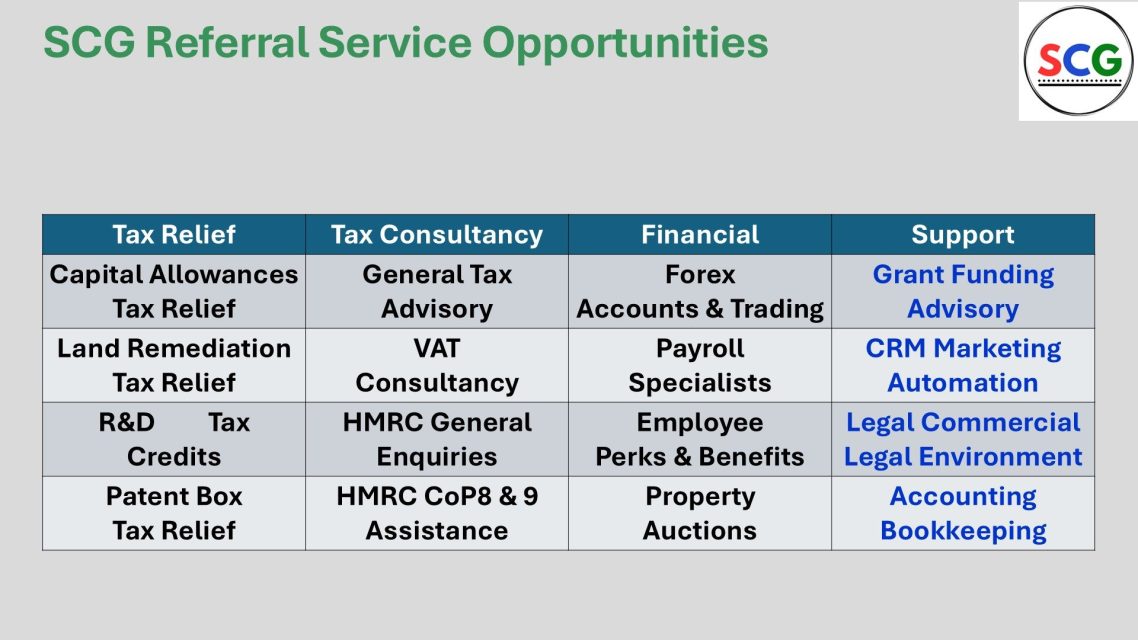

Tax Relief

The identification and verification of HMRC approved tax relief schemes such as:

- Capital Allowances

- Land Remediation

- R&D Tax Credits

- Patent Box.

Whilst some reliefs are currently popular and on occasions abused by rogue "advisors / specialists", many of these legislated tax reliefs are under utilised.

Capital Allowances, specifically the identification of CA that is actually embedded in the property, where 80% of commercial property owners are missing out on legitimate tax relief that is for the most part already lying within their property awaiting activation.

The R&D Tax Credits process is complicated and requires expert guidance in order to ensure full tax law compliance and the best possible tax advantage. It is highly recommended that recognised and duly qualified specialist vendors process any claims, regardless of the type of R&D, the industry or the monetary value of the potential claim.

Our partners are verified experts in their field and provide full, comprehensive reviews and reports, ensuring the maximum tax relief within statutory guidelines and at market competitive fee structures.

Tax Consulting

VAT Advisory

HMRC Enquiry Defence

Expert advice and strategies to optimize your tax obligations, ensuring compliance and maximizing savings.

In the difficult trading and tax regimes being imposed upon businesses of all sizes, it is imperative that proper, cost effective and legal tax planning is maintained in order to ensure the best possible margins are reached.

VAT is a huge chunk of all transactions. With complex rules governing what is or is not subject to VAT, when, where and why is a ongoing issue that needs careful and expert guidance on. Our network includes highly rated expertise in this arena.

This service sector also includes specialist tax defence or mitigation from complex HMRC Enquiries and Investigations. This service is provided by well established ex high level HMRC managers that know the process and law pertaining to such enquiries as CoP8, CoP9 and other serious investigations.

Employer & Employee Perks

Employee Benefits Solution with a Difference

Managing your business overheads and costs has never been more challenging, from finding ways to mitigate inflation-busting rises right across the supply chain to engaging, retaining and recruiting staff.

Our specialist partner in this arena helps you do both.

● Significantly enhances the Business’s “Employee Value Proposition”

● Provides wide-reaching benefits to the employees ( Shopping discounts, private medical health insurance, Health & Wellbeing Counselling etc etc, all at zero cost, driving engagement, retention, and loyalty.

● We guarantee to PAY YOU (the Employer business) the equivalent of 1% of your gross monthly payroll (that’s £10,000 for every £1million) as a support fee, whilst your business remains in the Employment Partnership.

● Reduces or completely removes any hard costs you may already have on your existing benefits and reward programmes.

● Provides better asset protection for shareholder capital by reducing Employment Liabilities.

Our unique proposition has historically only been accessible to Blue Chip Corporates, from this year we have opened this for the S.M.E.s of the UK.

Underwritten and supported by global retailers and Employment Payroll specialists, FCA authorised.

There is NO COST to the employer.

SCG can set your company and employees up to access these fantastic value added benefits, either at no or very low cost per head.

Grants

Funding

Forex

Our network includes specialists in Grant Funding, a growing resource used by more and more businesses. Not only do they identify the huge variety of available grants, they also facilitate the application and governance processes for those businesses that need such assistance. They are UK Public Sector specialists in Bid Writing (aka Tender Writing), Grant Writing, Business Advisors (aka finding contracts), Market Research, and Carbon Reporting.

Business funding from the high street commercial banks can often be a tricky if not expensive process. Our network includes specialist funding organisations that are all FCA compliant and most often at very competitive rates.

International trade is continuous, requiring efficient and effective foreign exchange and banking services with a reliable FCA registered provider with the latest technology. Our FX partners are a globally regulated international payments company with two decades of trading.

The FX team work closely with finance teams to minimise the risks and exposure associated with receiving or making currency payments - exchange rate fluctuations can impact the bottom line by weakening revenues or inflating costs. Banks generally don’t focus on this area, and they can be a costly option for these payments, offering poor exchange rates, high transaction fees, along with no proactive service.

Accounting Bookkeeping

Payroll

Most business have, or at least should have, their own accountants looking after their accounting and basic tax affairs.

However, many SMEs don't have such services in place, despite the risks involved in "doing your own thing". Tax laws and regulations change with the weather seemingly, especially now with MTD coming into effect, so it it always wise to have someone ensuring things are kept up to date and compliant to HMRC rules.

Our network of qualified accountants and bookkeepers are there to assist in the management of financial records, tax compliance and general financial awareness.

Included in the portfolio are Payroll specialists, which are increasingly used directly by businesses and accountants alike. The need to provide accurate payroll records for both employer and employee is paramount.

Insurance Consultancy

Brokerage & Referrals

Comprehensive insurance solutions, connecting you with the best providers and insurers to safeguard your business.

The portfolio includes:

- Commercial insurance

- Buildings

- Equipment

- Vehicles

- Key Man Business insurance

- Directors

- Partners

- Key Managers

- Employee benefits

- Life insurance

- Disability insurance

- Pensions

- Medical insurance

- Private hospital cover

- Emergency care cover

- Tax Investigation insurance

- Professional fee cover

- Enquiry defence

- Technical helplines

Legal Advice

Property Services

Business Rates

Legal

Professional legal advice to navigate the complexities of business law, defence and compliance.

From corporate to individual services, the extent of legal advisory covers:

- General commercial matters

- Trading and Contracts

- HR and employer / employee rights

- Environmental matters

Property Auctions

Property transactions can be long, tedious and expensive. Our partners offer a both private and commercial property auctions, offering a much faster and economical process to get your property portfolio sold or purchased, nationwide.

Business Rates

Commercial property owners (and tenants) know the heavy financial burden paying local authority business rates for their premises. Having a review of what you're paying very often can lead to rate mitigation, discounted fees or rebates. Our specialists in this arena are experts in checking and assisting in the process, and with a no-win-no-fee service structure there's nothing to lose, other than paying too much on your rates!

Business Networking

Customer Journeys

Staff Training

Networking

Connecting you with a network of professionals to foster growth and collaboration.

Should you manage or host a business network, please feel free to invite us to join or review the option and help spread the network.

If you have a unique service offering, or one that would further compliment the existing portfolio, please do get in touch with us directly.

Customer Journeys

By looking at your business through your customer’s eyes, a specialist consultancy will map out the different journeys and experiences they will have as they go through your business.

Our specialists quickly find the changes you need to make to your marketing and processes to attract more leads, convert more leads to sales, turn one off purchasers into loyal customers, reduce queries and complaints, and turn your customers into a great source of new business.

Staff Training

Specialised training for management and staff is often overlooked or seen as an unnecessary expense ... to the businesses detriment.

We have specialist Resilience Training partners that rather than delivering off the shelf packages prefer to work closely with clients to provide a bespoke offering tailored to the needs and delivery requirements of the company.

SCG has several specialist training and business customer journey consultants catering for businesses of all sizes - we can introduce you to the relevant professionals.

Contact us

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.